Strengthen the relationship between file reviews, risk, and remediation. Surface trends and unlock insights which improve governance, risk management, and assessment of your Consumer Duty. Save time managing and analysing file reviews.

FileChecker is a regtech platform with in-built automations that streamline your file reviews, improve your management and analysis of data, and enrich your MI.

Used by firms in many different sectors including Wealth Management, Stockbroking and Insurance.

Strengthens the relationship between file reviews, risk and remediation. You can evidence risk management, how you tackle root causes of potential harms, and mitigate poor outcomes.

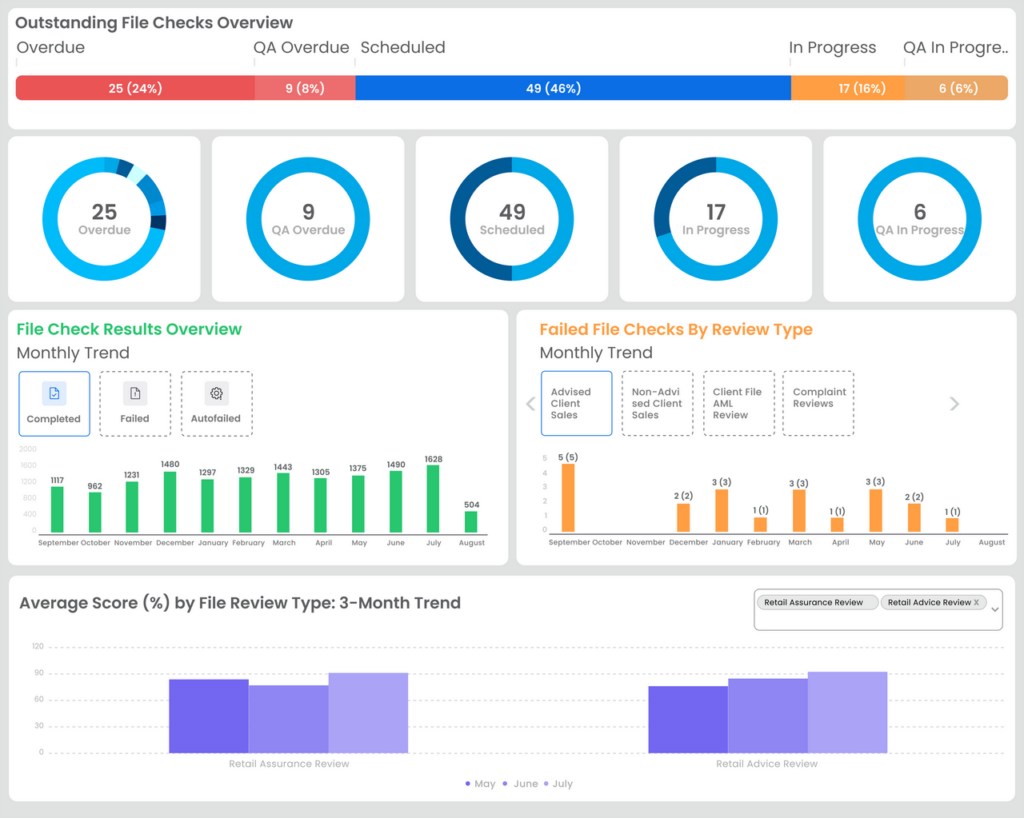

‘Real time’ MI and dashboards surface trends and unlock insights. You’re empowered to make better decisions, improving governance, risk management, and assessment of your Consumer Duty.

Inbuilt processes that bring 1st, 2nd and 3rd line of defence onto the same platform and file reviews. Demonstrates strong file review and Consumer Duty governance.

Simplifies file review management. Saving you time and resources by automating processes and making it easier to monitor, track, evidence and produce MI.

Easily customisable platform allowing you to build your own file review framework(s) with an automated marking system that includes auto fail questions.

Assess and compare different customer types and products, and identify how customers with vulnerable characteristics are faring in comparison to others.

Single system that can be used by internal teams including front line, compliance, risk, and audit, as well as external consultants.

User hierarchy allows you to give different groups access to their own data helping embed Consumer Duty and Inform training and communications that enable you to improve customer outcomes.

Easy search facility and full audit trail with history tracking to evidence your compliance and risk management.

My Compliance Centre supports more than 200 companies and over 10,000 people use our system.

We’re trusted by firms of all sizes, from start-ups to large enterprises with decentralised compliance functions, and in financial services sectors that include asset and investment managers, capital markets, fintech, insurance, wealth management, payment services and consumer credit.

Just launched: our new solution for payments firms. Click here for more…