Ten years’ worth of fines are now published on the FCA’s website. We thought it might be ‘fun’ to analyse these and see where the risks lie for regulated firms.

The analysis below is in two parts. Firstly, we present a short macro analysis. While that is interesting and tells a story it is difficult for any individual to draw too many conclusions.

So, we progressed our analysis to consider specific risk areas, such as which financial services sectors and which activities are most at risk. Thereby, we hope to help compliance teams to establish where their priorities might lie in building their compliance frameworks.

And an early spoiler alert: if you had asked me ‘Ben, what is the most common reason for an FCA fine?’ I would have said ‘AML’. I could not have been more wrong! It is the highest average fine, but only the 7th most common reason!

A Note on Our Methodology

We use the term ‘sectors’ to indicate what might also be ‘verticals’ within the financial services industry. e.g. banking and asset management are ‘sectors’.

To support the analysis, we listed all the fines and categorised them across 18 different risk areas and 11 different sectors.

However, there is, space for much subjectivity here. e.g. are JP Morgan a bank? Or an Asset Manager? Or Capital Markets firm? Are Tesco Bank a Bank or Personal Finance firm? Is a Building Society ‘banking’ for the sake of our analysis? And, in terms of categories of fine, where does the line fall between general TCF failings, mis-selling and suitability of advice? And so on.

However, we have made a call on all these issues and the analysis below reflects our subjective view.

Macro Analysis of FCA’s Regulatory Fines 2013-2022

| How many fines? | 247; roughly one every two weeks or 25 p.a. |

| Total amount fined? | £4.5bn (average £18.4m) |

| Number of fines to firm | 142 (£4.4bn) |

| Number of fines to individuals | 105 (£130m) |

| Year with most fines | 2013 (48 fines) |

| Year with fewest fines | 2021 (10 fines) |

| Company with most fines | Barclays (6 fines, £447m) |

| # companies fined more than once | 15 (A load of banks + Sesame, JLT and the Pru) |

| # companies fined more than twice | 5 (Barclays, Lloyds, RBS, DB, the Pru) |

| Number of fines over £100m | 17 (all to banks) |

The largest FCA (or FSA) fine ever is the £284m to Barclays for market conduct failings in their FX trading business. Conversely, Mr Zaffar Tanweer’s £1,100 fine is the lowest.

The largest fine received by an individual was Stuart Ford who was fined a mind-blowing £76m in relation to the Keydata scandal. Fortunately, of the other 141 fines levied against individuals, only four additional fines were greater than £1m.

Risk Analysis

There are two angles we will look at to help with this: industry sector and the category of fine.

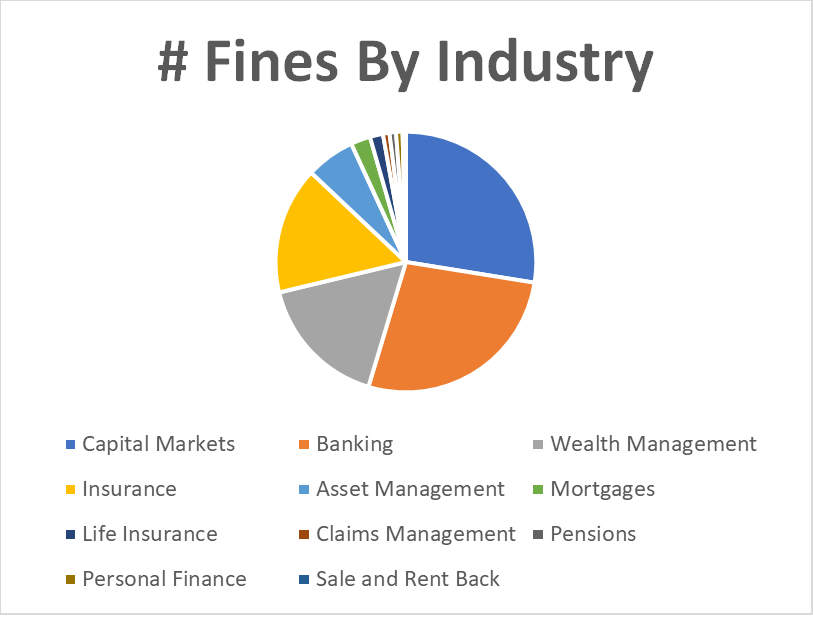

Firstly, we identified 11 distinct industry sectors that had attracted FCA fines. Which industries are the highest risk?

To really evaluate that, I think you have to factor in the number of transactions carried out, the number of firms in the sector and the amount of business conducted generally. Simply to say ‘standards in banking are clearly lower’ does not reflect the sheer scale of banking operations, the average size of firm in banking, the scope of activities within banks and so on, compared with – say – Asset Management or Wealth Management.

However, this is it, and banking wins the prize for the highest aggregate fines (although, not the most fines – not surprising as there are only 200 odd of them in a pool of 50,000 regulated firms):

| Sector | Aggregate Fines | #Fines | Average Fine |

| Capital Markets | £142m | 68 | £2,094,771 |

| Banking | £4,055m | 67 | £60,522,595 |

| Wealth Management | £38m | 41 | £916,385 |

| Insurance | £139m | 39 | £3,561,999 |

| Asset Management | £71m | 15 | £4,759,211 |

| Mortgages | £3m | 6 | £438,622 |

| Life Insurance | £85m | 4 | £21,166,875 |

| Claims Management | £0.16m | 2 | £80,500 |

| Pensions | £8m | 2 | £4,153,400 |

| Personal Finance | £4m | 2 | £1,793,150 |

| Sale and Rent Back | £0.026m | 1 | £26,600 |

| Grand Total | £4,544,716,058 | 247 | £18,399,660 |

Viewed graphically, it is really easy to see that banking dominates if assessing the value raised through fines, with no other industry even registering on the scale.

However, when we look at the same graphic, but this time plotting the number of fines, we can see that a number of sectors feature in the analysis. Combining these two graphs just highlights how much higher the average fine is within the banking sector then any other sector.

Each sector has their own story to tell; different risks and challenges. Here is an analysis of the most frequent reason for a fine, by sector.

| Sector | Most Common Category | Occurrences |

| Capital Markets | Market Conduct or Abuse | 44 |

| Wealth Management | Advice Failings | 20 |

| Banking | AML | 15 |

| Insurance | Client Money | 10 |

| Asset Management | Client Money | 4 |

(No data of significant relevance for other sectors.)

Previously, as a compliance consultant working with firms across the industry and looking from the outside in, I used to routinely think about what sector was the highest reward for the risk taken. Unsurprisingly, I normally concluded Asset Management, particularly for a non-retail business, and these numbers validate that.

Let’s now consider which categories of fine occur most often:

| Category | # Fines | Average Fine | Aggregate Fines |

| Market Conduct or Abuse | 57 | £38m | £2bn |

| TCF | 29 | £15m | £447m |

| Mis-selling | 29 | £9m | £268m |

| Client Money | 24 | £11m | £266m |

| Advice Failings | 24 | £1.8m | £44m |

| Senior Management Failings | 20 | £10m | £194m |

| AML | 18 | £43m | £767m |

| Dealing with the regulator | 12 | £3m | £39m |

| Transaction Reporting | 10 | £15m | £155m |

| Fraud | 9 | £362k | £3m |

| ABC | 4 | £39m | £157m |

| Operational Resilience | 3 | £29m | £88m |

| Listing Rules | 2 | £8m | £16m |

| Conflicts | 2 | £1m | £1.6m |

| Redress | 1 | £4m | £4m |

| Breaching FCA sanctions | 1 | £63k | £63k |

| Client Information | 1 | £37k | £37k |

| AR oversight | 1 | £25k | £25k |

| Grand Total | 247 | £18,399,660 | £4,544,716,058 |

Note: some of the Market Abuse fines are not regulated entities, but listed firms and sometimes a single offence catches a number of individuals as well as a firm. Even so, the frequency of Market Abuse is clear to see, followed by mis-selling and customer mistreatment in various forms and different versions of financial crime.

I did a double-take when I saw the how low the average fine for fraud is (to be clear, that is £k not £m). However, there is a reason. Mortgage and insurance fraud is committed – generally – by very small IFAs and brokers, and on a very small scale, relatively speaking, and the fines are commensurately small.

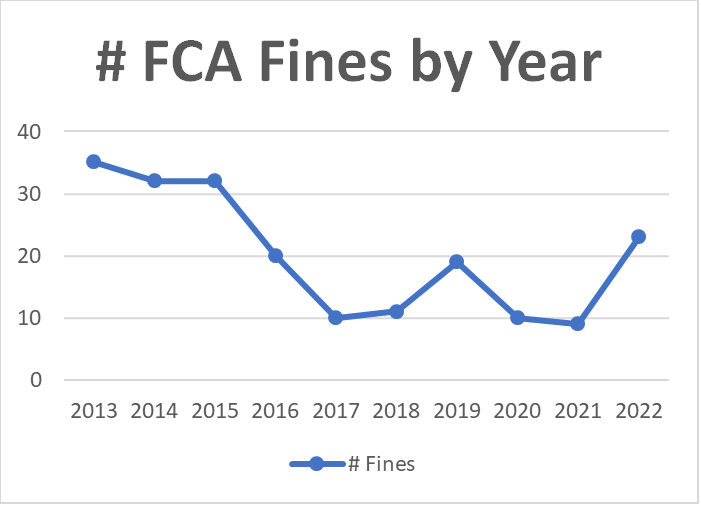

Trends Over Time

That leads us on to consider what has changed in ten years?

Firstly, let’s look at the general trend of fines over time. In short, the frequency has dropped, but with a pick-up in 2022.

Why might that be? There could be numerous factors affecting the two trends seen here (downwards then upwards), so please let me speculate for a minute.

Firstly, I believe compliance controls in some areas have improved dramatically in response to FCA pressure. Retail investment advice (on the back of the RDR) and financial crime controls come straight to mind, as well as the entire market sorting out their transaction reporting and client money controls, which so many firms got wrong over an extended period of time.

However, I also think there are some influential macro factors. The traditional political-regulation cycle of ‘let’s have easier regulation’ back to ‘oh no, our regulations are too lax; let’s quickly tighten up’ is clearly in evidence.

Dame Gloster’s report into the LCF scandal was released in December 2020. This was a major, major event for the FCA. Even before it came out the temperature at the regulator had changed: they knew what was coming and had tightened their risk appetite. Nikhil Rathi was appointed CEO of the FCA in October 2020 to deliver a new and more aggressive supervisory culture at the FCA. The aggression of the FCA’s narrative stepped up immediately and supervisory and enforcement activity with it. There is a delay between more aggressive supervision turning into more fines, which explains the uplift in fines in 2022 rather than 2021.

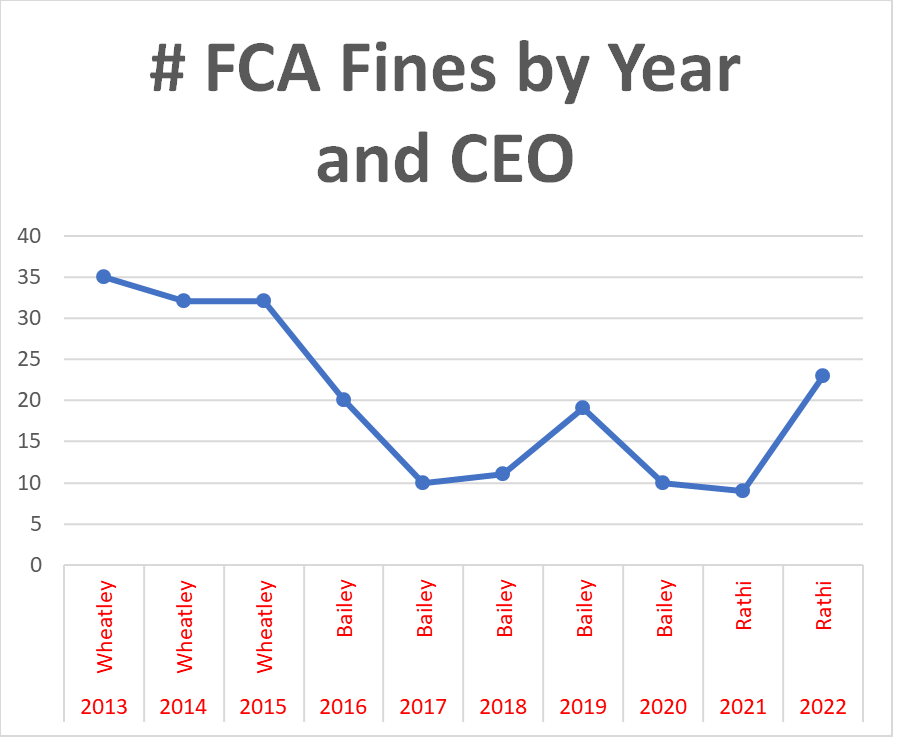

Superimposing FCA CEOs onto the graph above is interesting:

Is it as simple as Andrew Bailey is a more moderate character and he was CEO during a less aggressive period in the cycle? It is probably not quite that simple, but it is interesting to see. I also remember Martin Wheatley being ‘full on’, which the numbers reflect, and Nikhil Rathi clearly also has that brief. (Based on what he says in his speeches, FCA activity, aggressive ‘anti-firm’ metrics etc.)

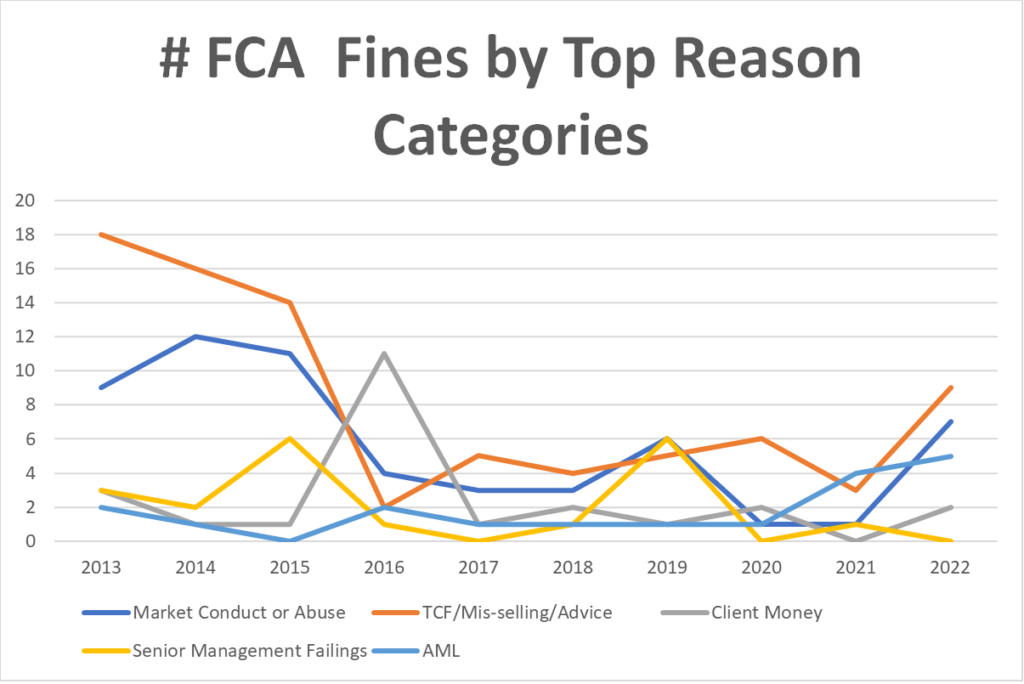

A final comment on the evolution of fines is to examine how the different categories of fine have evolved. The graph below takes the top 7 recurring categories, representing 81% of fines, and plots them over time.

(Note: there are only 5 lines because, we have combined TCF/advice/mis-selling into one to make this graph more readable.)

Let’s quickly interpret:

- Market Conduct was a massive issue, it had improved generally and might be making a comeback

- TCF/Mis-selling/Advice is never going away – ref. Consumer Duty

- Client Money had its day as a set of regulations no one had implemented correctly, but is generally under control now

- SMCR did NOT lead to a spike in fines for Senior Managers. It has been a matter for debate as to whether this means SMCR is working or not?

- And, for me at least, it is surprising how low AML fines are, although, as we saw above, when they happen, these fines can be huge. I believe this reflects the relative maturity of AML programmes and supporting technology

What does this mean for the financial services industry and for Compliance Officers?

At industry level, it is interesting to see that it is not as simple as to be able to say ‘only financial crime with supporting laws actually gets punished.’ AML, Fraud, B&C and Market Abuse fall into that category, but the regulator clearly is prepared to take action against other areas of misconduct.

At an individual firm level, well, let’s be honest, you already knew your key risks and where you might be vulnerable. However, this analysis might help you focus and highlights the need to be continually horizon scanning for the ways in which these breaches can evolve.

This analysis does clearly highlight how risks vary dramatically by industry, which is already reflected in most firms’ compliance frameworks. It also highlights that external factors affect what happens at the regulator – and that affects what happens in your firm. Political pressure on the regulator impacts the mindset of senior regulators and the culture they drive. This goes in cycles to an extent. Managing your Board’s expectation as to where we are in the cycle might help them understand your actions.

For senior compliance officers new to their role, it highlights how important it is to ensure that previous regimes had proper assurance in place, and the need to take stock before making too many decisions as to how to progress. If there are gaps in your employer’s assurance framework, which have been ignored for years, then that needs working through.

Consolidated FCA Fines

You can download our consolidated fines list with our analysis here.